A serene underwater world, where divers glide through crystal-clear waters, witnessing a mesmerizing spectacle that resembles snowfall. But hold…

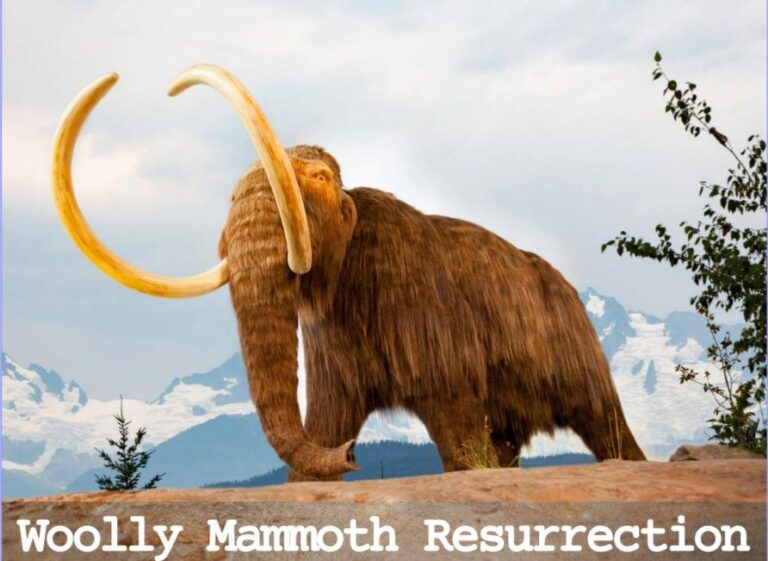

RESURRECTION OF THE WOOLLY MAMMOTH is possible? Introduction Have you heard about the latest scientific endeavor to bring back…

Top Eight Trending AI Technologies of 2023 Generative AI Quantum Machine Learning Hey there! So, you know how AI…

Why do we forget our dreams when we wake up? When You Wake Up One reason you might not…

AI Analytics AI Database Design Welcome to the intriguing universe of artificial intelligence (AI), where database and AI form…

Introduction to Presence Technology Imagine you’re trying to reach a friend. You’ve been calling, leaving voicemails, even resorting to…

Introduction to Pink Sunsets Sunsets are a daily spectacle that captivates us with their vibrant hues of orange, yellow,…

Have you ever wondered about the fascinating world of octopuses? These marine creatures are nothing short of extraordinary, boasting…

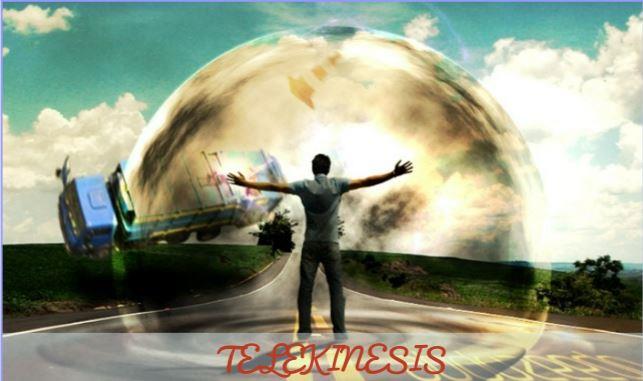

IS TELEKINESIS REAL ? The Wonders of the Human Mind The human mind is a marvel, a complex network…